Want to step into the world of forex trading but not sure where to start? BCR MoneyTrade makes currency trading easier, smarter, and more accessible than ever. With real-time market insights, low spreads, and a user-friendly interface, you can trade major and minor currency pairs confidently, whether you’re a beginner or a seasoned trader. Learn how to analyze forex markets, manage risks, and execute profitable trades using BCR MoneyTrade’s advanced trading tools designed to help you grow your wealth in 2025 and beyond.

Table of Contents

What is BCR MoneyTrade?

BCR MoneyTrade is an online forex and CFD trading platform that allows users to buy and sell global currencies and other financial instruments such as commodities, indices, and shares. It is designed for both beginners and experienced traders who want a safe, fast, and user-friendly platform to trade the global markets.

BCR MoneyTrade operates under BCR (Broker Credit Service), a regulated and trusted broker known for its transparent trading environment, competitive spreads, and advanced trading tools. The platform provides real-time market data, intuitive charting features, and secure trade execution, helping traders make smarter and faster decisions.

With BCR MoneyTrade, you can easily trade major and minor currency pairs, monitor price movements, and access detailed market analysis tools, all in one place. It also offers educational resources and demo accounts, making it ideal for those who are new to forex trading and want to learn without taking significant risks.

In simple terms, BCR MoneyTrade is a digital trading platform where you can trade currencies online, manage your trades securely, and grow your trading skills step by step. Its combination of technology, reliability, and simplicity makes it one of the best options for anyone looking to start or expand their forex trading journey.

Why Choose BCR MoneyTrade for Forex Trading?

When looking to trade currencies online, it’s essential to pick a platform that offers reliability, strong features, transparent conditions, and support for your trading style. Below are the key features of BCR MoneyTrade (often listed simply as “BCR”) and how they support effective currency (forex) trading.

1. Wide Market Access & Instruments

- BCR offers 40+ forex currency pairs (majors, minors, exotics) for trading.

- Beyond foreign exchange, you can trade CFDs on commodities, indices, shares, and metals.

Why it matters: For someone trading currencies, having access to a large variety of coins or currency pairs and instruments means more opportunities for diversification. When you know how to trade currencies with BCR MoneyTrade, you’re not limited to just one or two pairs.

2. Advanced Trading Platforms & Tools

- BCR supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

- MT5 features include depth-of-market, more indicators, and multi-currency backtesting, which are helpful for forex trading strategies.

- Mobile and desktop versions (“trade at will… one tap”) enable currency trading anywhere.

Why it matters: When you’re trading Forex, speed, flexibility, and analysis tools are key. Using platforms like MT4/MT5 means you can analyse currency chart patterns, set stop-loss/take-profit, and execute trades smoothly.

3. Competitive Spread, Leverage & Execution

- The site mentions “spreads from 0.0+ pips” for some instruments.

- Up to 400:1 leverage is offered by BCR MoneyTrade.

Why it matters: Lower spreads reduce the cost of entry and exit, and higher leverage (while riskier) means you can potentially amplify currency trading results. But you must know what you’re doing.

4. Regulatory Claims & Client Fund Protection

- BCR claims segregated client funds, which means client assets are held separately from company operational funds.

- It states that it is multi-licensed/regulated in several jurisdictions.

Why it matters: In forex trading, trust and security of funds are vital. Suppose you’re going to use BCR MoneyTrade for currency trading. In that case, you want to ensure your funds are protected and the broker is credible.

5. Support for Diverse Trading Styles

The platform supports scalping, robots, copy-trading, and intraday trades.

Why it matters: Whether you’re a beginner trading currencies or a more experienced trader, having a platform that supports multiple strategies means you can tailor how you trade major and minor currency pairs.

6. Real-Time Analysis, News & Education

The broker provides market news, analysis, and outlooks.

Why it matters: For currency traders, economic events, interest rates, and news can shift currency values quickly. A platform that offers timely market insight supports smarter trading.

Is BCR MoneyTrade a Good Choice for Currency Trading?

Based on the official features of BCR MoneyTrade, there are strong arguments in favour of using it for trading currencies:

- Access to a wide range of currency pairs and global markets.

- Powerful platforms (MT4/MT5) with advanced tools for analysing currency charts.

- Competitive trading conditions (low spreads, high leverage) are suitable for serious forex traders.

- Claimed fund protection and regulatory presence add to credibility.

- Flexibility of trading styles and real-time market resources support your currency trading journey.

However, and this is important, any trader must understand the risks of forex trading: currency markets can be volatile, leverage can amplify losses, and always independently verify the broker’s claimed regulation before depositing funds.

If your article’s goal is “how to trade currencies with BCR MoneyTrade”, then highlighting these features while linking them to the user’s real benefits (“you can trade USD/EUR, GBP/JPY, etc with tight spreads,” “you can use MT5 tools to set stop-loss and automate trades,” “you can diversify beyond major pairs to exotics”) will help your content rank and serve the user.

How to Use BCR MoneyTrade – Step-by-Step Guide

Here we will provide you with a step-by-step guide on how to use BCR Moneytrade for trading.

Quick overview (what you’ll do)

Create a MyBCR account → 2. Verify identity → 3. Fund account → 4. Install/open MT4/MT5 or WebTrader → 5. Choose a currency pair → 6. Analyse → 7. Place order (with stop-loss / take-profit) → 8. Monitor & withdraw when ready.

1) Open an account (MyBCR)

Visit the BCR client portal (MyBCR) and click Sign up / Open account. You’ll enter your name, email, phone, and create credentials. The client portal is the control center for deposits, withdrawals, and account settings.

Why: MyBCR links your trading accounts, shows balances, and provides access to tutorials and platform downloads.

2) Complete Verification (KYC)

Upload a government ID (passport/ID card) and proof of address (utility bill). Follow the portal prompts to finish account verification.

Why: Verification unlocks live trading, deposit/withdraw options, and increases account security.

3) Fund your trading account (Deposit)

Log in to MyBCR → My Account → My Deposit, pick a payment method (card, bank transfer, e-wallets where supported), and follow the steps. Processing times vary by method.

Tip: Start with a small test deposit to confirm methods and withdrawal times.

4) Download/open a trading platform (MT4, MT5, WebTrader, Mobile)

BCR provides MetaTrader 4 (MT4) and MetaTrader 5 (MT5), plus WebTrader and mobile apps. Download the client that fits your device or use the web version. MT5 offers extra indicators and depth-of-market features useful for Forex.

Why: These platforms let you view charts, place orders, set stops, and run automated strategies (EAs).

5) Open a market (currency pair) to trade

In your platform, go to the Market Watch / Symbols list and pick a currency pair (e.g., EUR/USD, GBP/JPY, USD/TRY). BCR lists 40+ FX pairs, including majors, minors, and exotics.

Tip: Beginners often start with major pairs (EUR/USD, GBP/USD) because they usually have tighter spreads and more predictable liquidity.

6) Do basic market analysis (technical + fundamental)

- Technical: Read charts (candlesticks), add indicators (moving averages, RSI), and check support/resistance levels.

- Fundamental: Watch economic calendar items (rates, CPI, employment), these move currency prices.

Why: Combining both gives better trade timing and risk control.

7) Place your trade orders & risk controls

In the platform, choose:

- Market Order (instant buy/sell) or Pending Order (limit/stop entry).

- Set Stop-Loss to limit losses and Take-Profit to lock gains.

- Size your position according to a risk rule (e.g., risk 1–2% of account per trade).

Practical: Use the order ticket to set lots, stop, and target before confirming the trade.

8) Monitor, manage, and close the trade

Keep an eye on the trade, news events, and margin level. Adjust stop or take-profit if your plan requires. Close manually or let the take-profit trigger.

Tip: Use alerts in MT4/MT5 or the MyBCR portal to stay updated on price moves.

9) Withdraw profits or funds

Use MyBCR → My Withdrawal to request a withdrawal. Follow the instructions, timeframes differ by payment method and card issuers.

10) Practice first- use Demo

Open a demo account (available in MyBCR / MT4/MT5) to practice strategies without risk. Demo trading helps you learn execution, order types, and platform features before going live.

Important platform features I checked (so you can trust these steps)

- MT4 & MT5 support: both desktop and mobile. Suitable for charting, indicators, and automated trading.

- 40+ FX pairs, spreads from 0.0+ pips, up to 400:1 leverage: gives flexibility for different trader styles (but leverage increases risk).

- MyBCR client portal: a central place for deposits, withdrawals, and account management.

Risk & Verification (don’t skip this)

Forex/CFD trading carries high risk; you can lose your deposit. Read BCR’s risk disclosures and product documents before trading. Verify any regulatory claims independently (licenses and client fund protections) in your region.

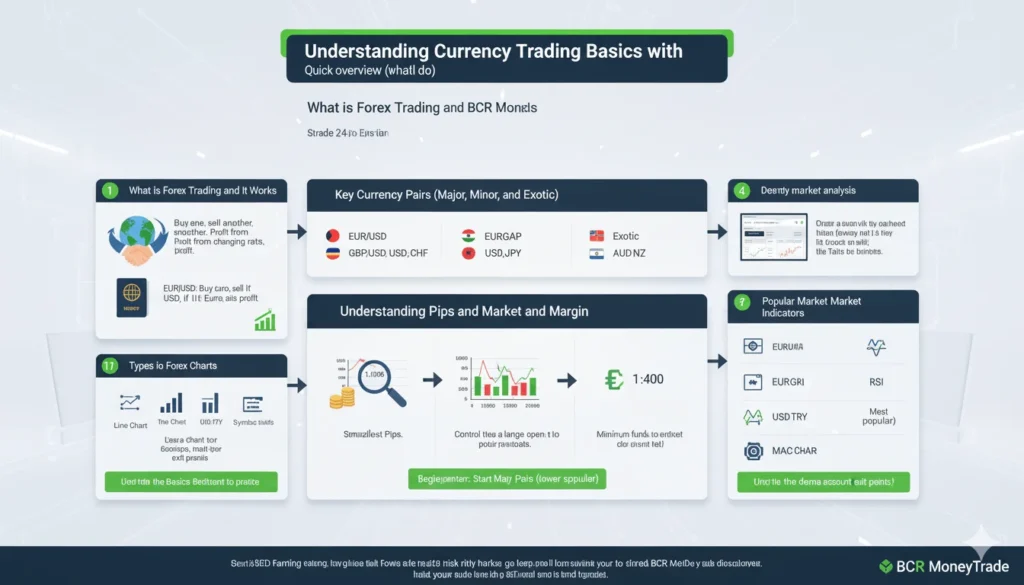

Understanding Currency Trading Basics with BCR MoneyTrade

Suppose you’re new to trading and want to learn how to trade currencies with BCR MoneyTrade. In that case, it’s essential to understand a few key forex trading concepts. These basics will help you deal confidently and make smarter decisions when using the BCR trading platform.

1. What is Forex Trading and How It Works

Forex (Foreign Exchange) trading means buying one currency and selling another at the same time. The goal is to make a profit from the changing exchange rates between currencies.

For example, when you trade EUR/USD, you’re buying euros while selling US dollars. If the euro increases in value against the dollar, you make a profit.

BCR MoneyTrade connects traders directly to the global forex market, allowing you to trade 24 hours a day, five days a week. You can access real-time prices, charts, and analysis tools through BCR’s MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms.

Key takeaway: Forex trading works by predicting whether one currency will rise or fall against another, and BCR MoneyTrade gives you the tools to trade both directions.

2. Key Currency Pairs (Major, Minor, and Exotic)

In Forex, traders trade currencies in pairs. Each pair shows how much one currency is worth compared to another.

BCR MoneyTrade supports over 40+ currency pairs, including major, minor, and exotic pairs.

Major Pairs

These include the most traded currencies worldwide and have the highest liquidity:

- EUR/USD (Euro vs US Dollar)

- GBP/USD (British Pound vs US Dollar)

- USD/JPY (US Dollar vs Japanese Yen)

- USD/CHF (US Dollar vs Swiss Franc)

Minor Pairs

These don’t include the US dollar but are still popular:

- EUR/GBP

- GBP/JPY

- AUD/NZD

Exotic Pairs

These involve one primary currency and one from a developing or smaller economy:

- USD/TRY (US Dollar vs Turkish Lira)

- EUR/ZAR (Euro vs South African Rand)

Tip: Beginners usually start trading major pairs because they have lower spreads and more predictable movements.

3. Understanding Pips, Leverage, and Margin

To trade effectively on BCR MoneyTrade, you need to understand three basic trading terms: pips, leverage, and margin.

Pips

A pip (Percentage in Point) is the slightest price movement in a currency pair.

For example:

If EUR/USD moves from 1.1000 to 1.1005, that’s a 5-pip increase.

Pips help you measure how much a currency pair has moved, and how much profit or loss you’ve made.

Leverage

Leverage allows you to control a prominent position with a smaller amount of money.

For example, BCR MoneyTrade offers leverage up to 1:400, meaning you can trade $40,000 worth of currency with just $100 of your own money.

While leverage can increase profits, it also increases risk. Always use it wisely.

Margin

Margin is the minimum amount of money you need in your account to open a leveraged trade. It’s like a security deposit.

If your account balance drops too low, BCR may issue a margin call, asking you to deposit more funds.

4. Reading Forex Charts and Market Indicators

Forex charts are visual tools that show how currency prices move over time. They help traders identify patterns and make better trading decisions.

BCR MoneyTrade’s MT4 and MT5 platforms provide advanced charting tools with real-time data and customizable indicators.

Types of Forex Charts

- Line Chart: The Simplest chart showing closing prices over time.

- Bar Chart: Shows opening, closing, high, and low prices.

- Candlestick Chart: Most popular, easy to read and great for spotting trends.

Popular Market Indicators

- Moving Averages (MA): Show trend direction over time.

- Relative Strength Index (RSI): Measures price momentum and overbought/oversold conditions.

- MACD (Moving Average Convergence Divergence): Helps identify trend reversals.

Tip: Use these tools to spot entry and exit points when trading on BCR MoneyTrade.

Learn the Basics Before You Trade

Understanding how forex trading works, knowing which currency pairs to trade, and learning about pips, leverage, and chart reading are essential for success on BCR MoneyTrade.

Start with a demo account to practice these concepts before trading live. Once you’re comfortable, you can move on to creating fundamental trading strategies and managing your risk effectively.

How to Trade Currencies on BCR MoneyTrade (Step-by-Step Guide)

Step 1: Choose a Currency Pair

First, log in to your BCR MoneyTrade account (via the MetaTrader 5 or MetaTrader 4 platform). Go to “Market Watch” or “Symbols” and select a currency pair you want to trade.

- Example pairs: EUR/USD (Euro vs US Dollar), GBP/JPY (British Pound vs Japanese Yen).

- Focus on a major or minor currency pair if you’re new, they’re more liquid and easier to trade.

Step 2: Analyse the Market (Technical & Fundamental)

Before placing a trade, you need to assess what the market is doing, both via chart patterns and via real-world economic events.

- Technical analysis: Use MT4/MT5 chart tools offered by BCR MoneyTrade to view candlestick charts, apply moving averages, RSI, and MACD indicators.

- Fundamental analysis: Check economic calendars (interest rate decisions, employment data, inflation reports) for the base or quote currency.

- By combining both, you can make a more intelligent decision: Is the currency pair likely to move up? Down?

Step 3: Decide Whether to Go Long or Short

After you complete your analysis, you must choose whether to buy (go long) or sell (go short) the currency pair.

- Go Long (Buy): You expect the base-currency to value increase relative to the quote-currency.

- Go Short (Sell): You expect the base currency to lose value relative to the quote currency.

- On BCR MoneyTrade, you can trade both directions, buying or selling, which means you can profit in rising or falling markets if your prediction is correct. (BCR emphasises “trade on both sides” in its education section).

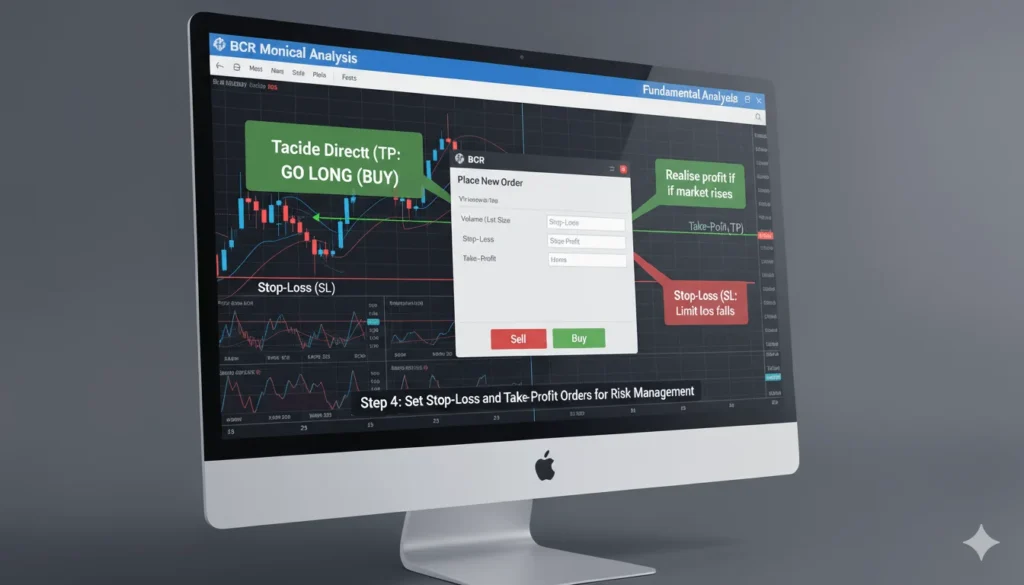

Step 4: Set Stop-Loss and Take-Profit Orders

Risk management is critical. On BCR MoneyTrade’s MT4/MT5 you should always set:

- Stop-Loss: A predefined level where you will exit the trade to limit your loss if the market moves against you.

- Take-Profit: A predefined level where you will exit to realise your profit once the market moves in your favour.

- Entering these at the time of placing a trade helps you trade with discipline and not just emotion.

Step 5: Execute and Monitor Your Trade

- Execute the trade by clicking the “buy” or “sell” button for your chosen currency pair with the desired lot size (position size).

- After execution, monitor your trade via the platform: track price movement, margin level, news updates, and your stop/take levels.

- If needed, you can adjust your stop-loss or take-profit to lock in profits or reduce risk as the trade evolves.

Step 6: Tips for Managing Risks Effectively

To trade currencies on BCR MoneyTrade, and do it sustainably, you need to manage risk smartly. Here are practical tips:

- Only risk a small percentage of your trading account on any one trade (for example, 1–2%).

- Use appropriate leverage; while BCR offers substantial leverage, remember that high leverage amplifies both gains and losses. (BCR warns that derivatives on margin carry high risk).

- Use stop-losses actively; do not skip them.

- Avoid trading during major economic announcements unless you have a clear strategy.

- Keep a trading journal of your trades (entry, rationale, outcome) to learn and improve.

- Use demo mode on the BCR platform to practise before going live.

Helpful Tools & Features on BCR MoneyTrade

1. Advanced Trading Platforms: MT4 & MT5

BCR offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for trading currencies, CFDs, and more. On the MT5 version, you get extra features such as: 21 timeframes, 38 technical indicators, 44 graphical objects, market-depth view (depth of market), and an economic calendar.

Why it matters: These platforms give you tools to analyse currency pairs, automate trading, and manage your trades on desktop or mobile.

2. Wide Market Single Account Access

You can trade 40+ major, minor, and exotic currency pairs through one BCR account. In addition, BCR supports other markets (commodities, indices, shares) using the same login.

Why it matters: You don’t need to open separate accounts for each market, this simplifies your trading setup and makes diversification easier.

3. Competitive Spreads, Leverage & Deep Liquidity

- BCR advertises spreads “from 0.0+ pips”.

- Leverage up to 400:1 for specific accounts.

- The depth of market (DOM) feature on MT5 allows you to see where large orders are placed.

Why it matters: Lower spreads reduce trading costs, and the depth of the market helps you understand liquidity. High leverage enables bigger positions (but increases risk).

4. Mobile & Web Trading Anytime, Anywhere

BCR supports WebTrader and mobile apps (iOS, Android) beyond desktop.

Why it matters: Being able to monitor and trade on the go is essential for active currency traders. You won’t miss key market moves or need to stay at your computer.

5. News, Market Analysis & Education Resources

BCR provides access to market news updates, weekly outlooks, educational materials, and analysis directly via the portal.

Why it matters: Good traders combine technical tools with market awareness. The platform’s built-in timely news and education equips you better to make informed currency trading decisions.

6. Support for Multiple Trading Strategies

BCR explicitly states support for intraday traders, scalpers, copy-trading, and automated trading (robots/EAs).

Why it matters: Whether you want to trade manually, follow others, or use automated systems, the platform gives you the tools. That flexibility is valuable for beginners and experienced traders alike.

7. Secure Infrastructure & Client Fund Protection

- Client funds are segregated (kept separate from company operational funds).

- Licensed and committed to industry standards for over 20 years.

- Why it matters: Security and trust are vital for online currency trading platforms. When your funds and trading data are well-protected, you can focus on strategy rather than worry about system risk.

Common Mistakes to Avoid When Trading Currencies on BCR MoneyTrade

Even though BCR MoneyTrade provides advanced tools and educational support, many traders, especially beginners, make preventable mistakes that can hurt their results. Here’s what to watch out for:

1. Trading Without a Clear Strategy

Jumping into the market without a trading plan is one of the biggest mistakes.

Many beginners rely on luck or emotions instead of structured analysis.

Avoid it by:

- Developing a forex trading strategy that defines your entry, exit, and risk-reward ratio.

- Use BCR’s demo account to test your plan before trading real money.

2. Over-Leverage and Ignoring Margin Rules

Leverage can multiply your gains, but also your losses. Many traders misuse high leverage without understanding margin requirements.

Avoid it by:

- Start with low leverage ratios (1:50 or 1:100) until you gain experience.

- Monitoring your margin level using the BCR MoneyTrade dashboard.

- Learning how leverage and margin work through BCR’s education center.

3. Ignoring Stop-Loss and Take-Profit Orders

Not setting a stop-loss or take-profit is like driving without brakes.

It’s one of the most common errors made by retail forex traders.

Avoid it by:

- Always adding stop-loss and take-profit levels when opening trades.

- Adjusting them based on technical indicators or key market levels.

- Using BCR’s built-in tools for automatic trade exit management.

4. Over-Trading and Emotional Decisions

Many traders chase every market movement, leading to impulsive trades. This emotional trading is a common reason for losing capital.

Avoid it by:

- Setting a daily trade limit or maximum loss threshold.

- Taking breaks after a loss, never try to “win it back.”

- Following data-driven decisions using BCR MoneyTrade’s charts and analysis tools.

5. Ignoring Economic News and Market Trends

The forex market reacts to global economic events, interest rates, inflation data, or political changes. Many traders ignore these updates.

Avoid it by:

- Checking economic calendars and news updates available within BCR MoneyTrade.

- Combining technical analysis with fundamental insights for smarter trades.

- Staying alert during high-volatility sessions (like NFP or Fed announcements).

6. Lack of Risk Diversification

Putting all your funds into a single currency pair is risky.

If the market turns against you, losses can multiply quickly.

Avoid it by:

- Trading multiple currency pairs to balance risk.

- Diversifying across major, minor, and exotic pairs on BCR MoneyTrade.

- Managing exposure using smaller trade sizes.

7. Neglecting Education and Continuous Learning

Forex markets evolve every day. Many traders stop learning once they start trading live.

Avoid it by:

- Exploring BCR’s education portal, webinars, tutorials, and market guides.

- Staying active in trading communities or following forex strategy updates.

- Reviewing your trading journal to learn from past trades.

Is BCR MoneyTrade Right for You?

Pros

- Regulated & Trusted: Licensed by ASIC and SCB, ensuring fund security and transparency.

- Advanced Platforms: Supports MT4 and MT5 with fast execution, automated trading, and advanced analysis tools.

- Low Spreads & Fees: Offers spreads starting from 0.0 pips, ideal for scalping and active trading.

- Diverse Market Access: Trade forex, indices, commodities, and CFDs under one account.

- Educational Support: Provides learning materials and research tools for better trading decisions.

- Flexible Accounts: Choose from Standard, ECN, or Demo accounts based on experience level.

Cons

- Limited Regional Availability: Not accessible in all countries.

- Complex for Beginners: MT4/MT5 may require basic learning for new users.

- Primarily Forex-Focused: Limited options for crypto or bond trading.

Who Should Use BCR MoneyTrade

- Beginners: Ideal for learning through demo accounts and educational tools.

- Intermediate Traders: Benefit from low spreads, leverage options, and fast execution.

- Advanced Traders: Suitable for technical analysis, algorithmic trading, and EAs.

Comparison with Other Brokers

| Feature | BCR MoneyTrade | Exness | XM | IC Markets |

| Regulation | ASIC, SCB | FSA, CySEC | ASIC, IFSC | ASIC, CySEC |

| Platforms | MT4 / MT5 | MT4 / MT5 | MT4 / MT5 | MT4 / MT5 / cTrader |

| Spreads | From 0.0 pips | From 0.0 pips | From 0.6 pips | From 0.0 pips |

| Leverage | Up to 1:400 | Up to 1:2000 | Up to 1:1000 | Up to 1:500 |

| Best For | Secure & balanced trading | High leverage users | Beginners | Algorithmic traders |

Final Summary

BCR MoneyTrade stands out as a trusted and well-regulated forex trading platform, offering powerful tools, secure trading conditions, and support for both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). It provides everything a trader needs, from real-time market analysis and risk management features to low spreads, educational resources, and 24/5 customer support.

Whether you’re a beginner learning forex basics or an experienced trader looking for precision execution and advanced analytics, BCR MoneyTrade delivers a seamless and efficient trading experience. With transparent pricing, regulated operations, and flexible account options, it remains a reliable choice for currency trading in 2025.

12. FAQs

1: Is BCR MoneyTrade safe for forex trading?

BCR MoneyTrade operates as a multi-regulated broker, but potential users should verify the regulatory status of their specific operating entity and consult recent user feedback.

Regulation: Recognized financial authorities regulate BCR entities. For example, some entities are licensed and overseen by the Australian Securities and Investments Commission (ASIC) (AFSL No. 328794) and the British Virgin Islands Financial Services Commission (BVI FSC). This multi-regulation provides a strong level of oversight.

Fund Safety: The broker employs standard industry practices, including the segregation of client funds. It means the broker keeps your deposited money separate from the company’s operational funds, which enhances security.

User Feedback: While having proper regulation is key, independent reviews suggest a mixed experience, with some customers reporting excellent service, while others have noted occasional issues with customer support or withdrawal processing. Always conduct due diligence before depositing large sums.

2: What is the minimum deposit to start trading?

The minimum deposit varies depending on the specific account type and the regulatory entity you choose. Still, it is typically set low to accommodate most traders.

Standard Minimum: For a standard account, the minimum initial deposit often starts around $50 USD or 300 AUD (Australian Dollars), depending on the regional entity and account specifications.

Account Tiers: BCR generally offers various account types (such as Standard, Elite, or Alpha accounts). The minimum deposit for premium accounts may be higher to unlock tighter spreads and commission structures.

Actionable Tip: You should consult the specific “Account Overview” or “Deposit & Withdrawal” section of the BCR website relevant to your jurisdiction for the most accurate and current minimum deposit requirement.

3: Can beginners use BCR MoneyTrade easily?

Yes, beginners are generally well-supported and can easily navigate the trading environment provided by BCR MoneyTrade.

Industry-Standard Platforms: BCR utilizes the globally renowned platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are intuitive, reliable, and come with extensive online support and tutorials, making them easy for new traders to learn.

Educational Resources: The platform often provides access to essential learning materials, including a trading glossary, market news updates, and educational courses, which are vital for a successful start.

Risk-Free Practice: The availability of a free demo account (see below) is the most critical tool for beginners to practice trading strategies without any financial risk.

4: How much profit can you make with currency trading?

There is no fixed maximum or minimum profit in currency trading. The profit potential is unlimited but comes with a corresponding risk of loss.

High Risk/High Reward: Forex trading is a highly leveraged activity, meaning small market movements can lead to significant profits or losses. It is not a get-rich-quick scheme.

Profit Drivers: Consistent profitability depends entirely on the trader’s skill, research, disciplined risk management (e.g., risking only 1-2% per trade), and the size of the capital they are trading with.

Reality Check: Most retail forex traders lose money. It is essential to start with education, utilize the demo account, and only trade capital you can afford to lose.

5: Does BCR offer a demo account?

Yes, BCR MoneyTrade provides a free and readily accessible demo account.

Purpose: The BCR demo account is offered on both MT4 and MT5 platforms, allowing new and experienced traders to simulate live trading conditions using virtual funds.

Benefit: This is perfect for testing the broker’s execution speeds, familiarizing yourself with the platform features, and perfecting your trading strategy before committing real money to a live account.

Access: You can typically open a free demo account on the official BCR website in minutes by providing basic contact information.